Real estate investing can be one of the most empowering ways for women to achieve financial freedom. At WREIN, we understand that no two investors are alike, and that’s a good thing!

Your personal goals, lifestyle, and risk tolerance play a big role in determining the right investment strategy for you. Today, in our WREINvestor Insights, we’re diving into two popular approaches to real estate investing: house flipping and buy-and-hold investing. Each has its own set of benefits, challenges, and financial rewards. Let’s help you decide which path aligns with your goals!

House Flipping For Beginners

House flipping involves buying a property, making strategic improvements, and selling it for a profit. This approach can be lucrative but does require strong planning and a clear strategy. One of the questions we get a lot is, “How much do you need to start flipping houses?” The short answer is, “That depends on a few things…” Let’s take a look.

You Will Excel At Flipping Houses If You Have

- Attention to Detail

You will need to identify design details that increase property value. - Budget Management

Staying on budget is crucial, so if you have strong financial discipline, flipping houses could be perfect for you! - Collaborative Skills

Building a trusted network of contractors, designers, and agents is key.

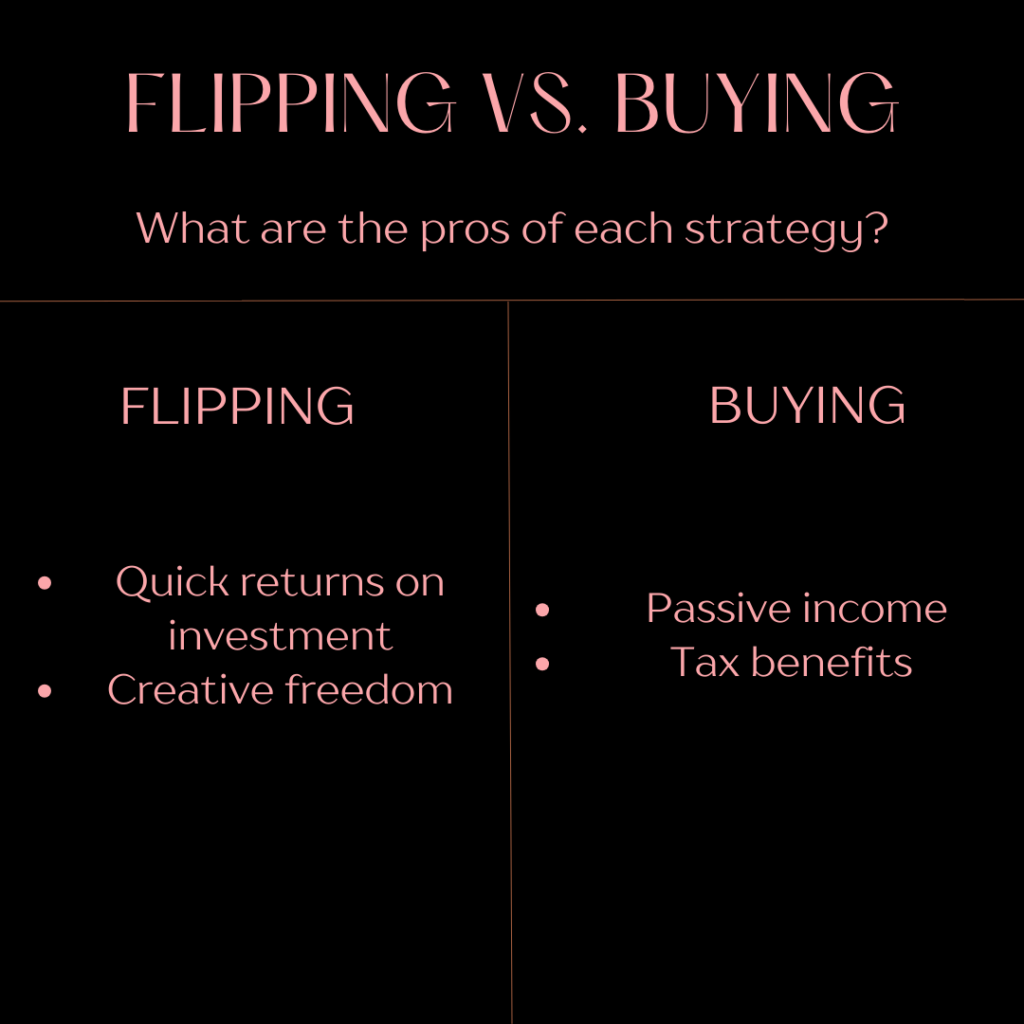

Pros of House Flipping Houses

- Quick Returns

You can see profits in months instead of years. - Creative Freedom

Transform a property into something beautiful and marketable. - Collaborative Skills

Use profits from one flip to fund your next project.

Challenges to Consider

- Time-Intensive

Managing renovations and sales can feel like a full-time job. - Market Fluctuations

The success of a flip depends on a favorable real estate market. - High Initial Investment

Costs for purchase and renovations can be significant.

Flipping Houses vs Rental Properties

Whether you choose to flip houses or go with buy-and-hold real estate investing, both strategies are powerful tools for achieving financial freedom. Success in real estate starts with having the right strategy in place, and a clear, thoughtful approach can make all the difference.

Here are a few questions you can ask yourself to help you evaluate house flipping vs buy-and-hold real estate investing.

What Are Your Financial Goals?

- If you want quick returns, flipping may be ideal.

- If you’re seeking long-term wealth, buy-and-hold investing might be better.

- Building a trusted network of contractors, designers, and agents is key.

How Much Time Can You Commit?

- Flipping requires active involvement in every stage of the process.

- Buy-and-hold investing allows for more passive management after the property is listed, especially with the help of property managers.

What is Your Risk Tolerance?

- Flipping can be riskier but offers higher potential returns.

- Buy-and-hold investing typically provides steady, predictable income.

Pro Tip

Consider starting small. Many women find success by flipping one property to build capital and then transitioning to a buy-and-hold strategy for passive income. You may want to gradually add to your real estate portfolio and diversify by owning several different kinds of real estate.

The Best Way to Start Investing in Real Estate

Before diving into your first project, make sure you have a solid game plan. Clearly outline your goals, timeline, and budget to ensure you stay focused and make informed decisions along the way. Whether you aim to generate quick profits through house flipping or create steady, long-term income with rental properties, having a well-defined roadmap will keep you on track.

Another key strategy is to learn the market. Understanding local property values, rental demand, and emerging trends will help you identify the best opportunities. Markets vary widely, so take time to research neighborhoods and assess their potential for appreciation or rental income. Networking with women who attend our WREIN Masterclass is a great way to stay abreast of market trends and keep in contact with like-minded investors.

By applying these strategies and embracing a growth mindset, you’ll be well-equipped to start investing in real estate and working toward achieving financial freedom.